News

- Details

Blue Trading Systems is a family of traders, technologists, innovators and committed professionals. The women and men that work here want to build something that not only meets demand but advances the industry. We are sharp, loyal and strategic.

In 2018, we wanted to highlight the people behind the name. These are the ones applying their knowledge, dedicating their time and investing their money in Blue Trading Systems. Throughout this year we invite you to learn more about the people building the solutions.

This week we are excited to introduce Kevin Darby, Co-founder and Managing Partner of Blue Trading Systems. Kevin will be in Florida next week at the Futures Industry Association Boca conference. If you would like to meet with him, please send him a note at This email address is being protected from spambots. You need JavaScript enabled to view it..

- What is your name, title and responsibilities at Blue Trading Systems?

-

My name is Kevin Darby, I am one of the four Co-founders of BTS and serve as Managing Partner. My responsibilities have shifted substantially since we started. During the early days we found that our way of thinking about volatility and risk as a trading firm was quite different from what ISVs were doing in the commercial software space, so I spent time reworking our vol and risk models to better satisfy new expectations.

Although I really enjoy technical work, and I still hop in the dev queue if it makes sense, it soon became clear that my focus should turn from software development to business development. Today I do sales calls, marketing strategy meetings and gather intelligence we use to help guide our company. It’s my responsibility to ensure that BTS gets enough exposure and data from the outside world to be a player in our space. I also manage our external partnerships and to a large extent, general customer relations.

- How did you get into this field of derivatives trading? Trader or technologist?

-

I sort of snuck in through the side door. I started as a intern on the CBOE floor in the summer of 1999 while still in college. I nervously muddled through an interview set up by my aunt with Blue Capital and was given a job entering trade cards into MicroHedge. My first day I miskeyed a trade, and, minutes later, as the loud, belligerent screams and insults came through the phone into my ear, I knew I’d found the place for me. The urgency and intensity of the trading world was appealing; I was fascinated by what seemed to be total chaos.

During my internship, I was able to make some company processes (like printing sheets!) more efficient through writing software and spreadsheets. Eventually the company sent me to North Carolina to meet Trevor Colvin, where I asked him to, “give me six months to figure this software thing out, otherwise fire me and I’ll go back to college.” He agreed, and over the next several years, I learned financial and software engineering through Trevor and the other members of the Blue Capital team. Over time, the chaotic picture drawn from the trading floor gave way to a serene view of the markets and of the mathematical relationships that must obtain without regard to market fluctuation or emotion.

- From your perspective, can you describe the relationship between BTS and its clients?

- We have a high degree of empathy for our customers; having been on the other side of the vendor-client relationship, we know that technology has capacity both to positively shape a trading group and to put a large divot into an otherwise rosy P&L. We recognize that we play a large part in our customers’ livelihood, as they do in our own. This is a big deal to us. We genuinely feel terrible about software errors and work like hell to correct them quickly.

- How has BTS evolved since you started at the company?

-

Tremendously. The transition from an R&D group with a single captive ‘customer’ to commercial software vendor took a lot longer than anyone expected. Our group and our software are more mature, now better through years of struggle together.

Our foray into the futures space is a large leap. We are developing BTS Spark in response to futures traders’ demand for more control over server hardware, better support from vendor partners, and lower latency. We’ve also established new partnerships, such as our relationship with Celoxica, which helps us provide an accelerated version of BTS Spark with expanded market coverage. I am excited to see how things shake out here.

- What are a few challenges the industry is currently facing?

- Consolidation in the market making space has made for tough growth conditions. This trend continues, not only in options, but in futures as well.

- What is your favorite piece of advice regarding trading, technology, the markets, leadership?

-

“My dear fellow, who will let you?”

“That’s not the point. The point is, who will stop me?”

—Howard Roark in response to The Dean of Stanton, The Fountainhead, Ayn RandI also like the paraphrase, “We can evade reality, but we cannot evade the consequences of evading reality” which is drawn from a passage in Atlas Shrugged

- If you had to pick, what animal would you be and why?

- Probably a vampire. Super strength, speed, and the ability to fly would come in handy. And then there’s immortality-- enough time to develop a deep understanding of any subject or embark on any project in perpetuity would be worth getting a little gristle in my teeth.

- Details

Blue Trading System’s is a family of traders, technologists, innovators and committed professionals. The women and men that work here want to build something that not only meets demand but advances the industry. We are sharp, loyal and strategic.

Through 2018, we wanted to highlight the people behind the name. These are the ones applying their knowledge, dedicating their time and investing their money in Blue Trading Systems. We invite you to learn more about the people building our solutions.

- What is your name, title and responsibilities at Blue Trading Systems?

- My name is Karl Ellefsen and I'm in charge of customer support and operations at Blue Trading Systems. If you call the customer support line you'll most likely speak with me. I help our clients with their day to day operations, whether it be how to interpret their risk reports, rolling PnL, adjust their vol curves, or help set up their UI. If you have a question about how to use BTS, I'm the guy that gets on the phone to help you. But my responsibilities don't end there. I also communicate with exchanges to assist with execution setup and problems as well as support our reporting and communication with clearing firms. I also occasionally write scripts to assist with automation of our operational tasks. As with most members of BTS, this is a few of the many hats I routinely wear.

- How did you get into this field of derivatives trading? Trader or technologist?

- I've always been a tech person. I knew since I was in elementary school that computers would be a passion of mine. During college I was an intern at a major hedge fund in Chicago, employed on a database administration team. I enjoyed it and eventually sought employment in the field upon graduation. I'd say that I'm definitely a tech person at heart. However, I was thrown head-first into customer support with no knowledge of trader vernacular. I've interacted closely with seasoned traders ever since and learned the language and skills that help bridge the gaps between the customer, developers, and operations within our company in order to assist our clients to the highest possible level.

- From your perspective, can you describe the relationship between BTS and its clients?

- We know our client's needs and we understand the urgency of our client's requests in the face of this fast-paced industry that the market demands. If there is a problem we will work without respite until that problem is resolved. My team is extremely dedicated and I can count on all of them to jump to my assistance if I call on them until a problem is resolved.

- How has BTS evolved since you started at the company?

- When I started at BTS the company was just beginning. I have been here since shortly after the company formed. We originally had a small client base that knew us and trusted us. We have grown our product offering as well as our customer base and, offer that same treatment and sense of caring to a new group of clients. Working with our developers, our support and operations teams have continuously worked to solve small and large problems for our clients until we achieve the results they demand. For instance, if there was a column such as a Greek that our client needed in their sheets, we've been happy to add it to accommodate them. On the performance side of things we'll make appropriate configuration changes specific to the problem until we get it right.

- What are a few challenges the industry is currently facing?

-

My colleagues have already mentioned the technical difficulties we face in the industry. As a more client-facing part of the team, I'll attempt to shine some light on the support side of things. Hands down, one of the biggest differences between this industry and others is the urgency of a problem. We understand that there is real money on the line.

Also, when looking at individual challenges, I think that employees with a tech background have a large barrier of entry when dealing with clients. In addition to their main field of expertise, they also must understand the rudiments of the finance world.

- What is your favorite piece of advice regarding trading, technology, the markets, leadership?

- Don't be afraid to try something new. We have all over-extended ourselves in order to benefit the company as a whole. I did not understand a lot of the technologies I know now before I started my employment at BTS. But through necessity and my own curiosity I've learned new skill sets in order to get the job done in the most efficient manner.

- If you had to pick, what animal would you be and why?

- I would be a crocodile. Why? Because as a product of millions of years of evolution they are still apex predators today. They are extremely durable and their stomach acid can even digest bones, hooves, and horns of their prey. Stay hungry.

- Details

Blue Trading System’s is a family of traders, technologists, innovators and committed professionals. The women and men that work here want to build something that not only meets demand but advances the industry. We are sharp, loyal and strategic.

Through 2018, we wanted to highlight the people behind the name. These are the ones applying their knowledge, dedicating their time and investing their money in Blue Trading Systems. We invite you to learn more about the people building our solutions.

- What is your name, title and responsibilities at Blue Trading Systems?

- My name is Eric Harding and I’m one of the non-managing partners. Day to day I have my hands in a lot of different pots. I own the market data pipeline that receives data from the exchanges and I’m also heavily involved in the management of our User Interface.

- How did you get into this field of derivatives trading? Trader or technologist?

- I’m definitely a technologist. I’m originally from the east coast but was working at Microsoft in Washington state when my wife and I decided to move to Chapel Hill. I interviewed with the guys that were then Blue Capital and really liked the team and the problems they were solving, so we came over in 2010. BTS spun out of Blue Capital Group about six months later.

- From your perspective, can you describe the relationship between BTS and its clients?

- BTS has a very close relationship with it’s clients. In a larger company you end up being several levels removed from your customers. However, due to our size and our culture we work directly with Support and with our customers every day. We aren’t insulated so when our customers feel pain we feel it too. It has a major impact on how we prioritize our development.

- How has BTS evolved since you started at the company?

- Incrementally. There haven’t been any huge changes but we’re always evaluating how we operate, and tweaking things to improve our effectiveness and efficiency. This applies to things like engineering and project management as well as how we support our customers.

- What are a few challenges the industry is currently facing?

-

With the slowing of increased CPU speed and Moore’s Law drawing to a close, the race for speed is going to get very interesting. Moving from easily mutable and inspectable software systems to more opaque hardware solutions like FPGA is going to come with some interesting challenges.

I also think that blockchains/cryptocurrencies are going to be a very interesting space to watch in the next few years. It’s almost a collision between the Silicon Valley way and the established way. Need to co-locate near GDAX? Sure, it’s in the cloud just spin up an AWS instance.

- What is your favorite piece of advice regarding trading, technology, the markets, leadership?

- It’s easy to find a complex solution to a problem but it’s usually worthwhile to keep looking until you find a solution that is simpler. Once you’ve found that it will feel obvious.

- If you had to pick, what animal would you be and why?

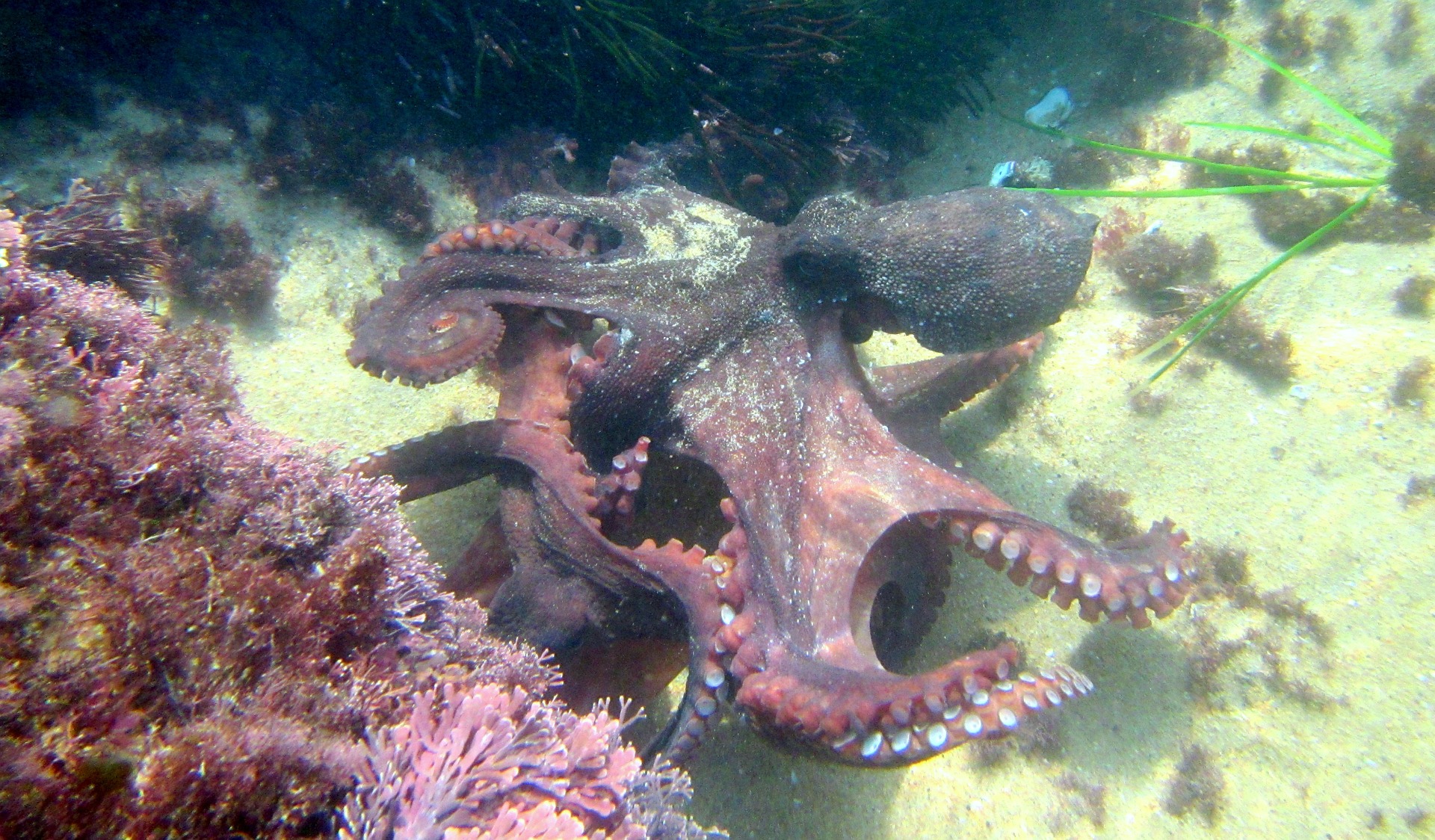

- Octopus. Who could say no to 6 more arms?

- Details

Blue Trading System’s is a family of traders, technologists, innovators and committed professionals. The women and men that work here want to build something that not only meets demand but advances the industry. We are sharp, loyal and strategic.

Through 2018, we wanted to highlight the people behind the name. These are the ones applying their knowledge, dedicating their time and investing their money in Blue Trading Systems. We invite you to learn more about the people building our solutions.

- What is your name, title and responsibilities at Blue Trading Systems?

- Sue C. Colvin, Office Manager: I am responsible for administrative duties and operational efficiencies. I make sure things run smoothly in the space we work. Finally, my staff reminded me that I try to make sure there are treats available in the office for everyone as well.

- How did you get into this field of derivatives trading? Trader or technologist?

- I was fortunate enough to have my son, Trevor Colvin, include me in this adventure. We don’t say we are a family company for nothing. From the technologists to the sales managers to our clients, we really care about each other.

- From your perspective, can you describe the relationship between BTS and its clients?

- From my experience, BTS makes clients a primary concern and customer service is of the highest importance. We take our customer’s challenges to heart and do everything in our power to help them meet their trading technology goals.

- How has BTS evolved since you started at the company?

- Each year I have seen growth in the company and the individuals developing their product. This is especially true for 2017 when we expanded from providing an options trading platform to helping traders in the futures space too. It was nice to see the team recognize a void in the market as well as how their strengths could meet that need.

- What is your favorite piece of advice regarding trading, technology, the markets, leadership?

- I feel that leadership is critical in motivating employees. My favorite piece of advice was issued by Phil Jackson, coach of the Chicago Bulls: Wisdom is always an overmatch for strength and good leadership should balance criticism with equal amounts of praise.

- If you had to pick, what animal would you be and why?

- I would be a dolphin. Their ability to have fun, and of course their intelligence. Dolphins seem so kind and sensitive and have the sweetest faces.

Have a Question?

Chicago

318 W Adams St

Suite 1724

Chicago, IL 60606

Telephone: (919) 913-0850

Chapel Hill

194 Finley Golf Course Road

Suite 100

Chapel Hill, NC 27517

Follow Us

Email: info@bluetradesys.com

Twitter: @bts_software

LinkedIn: Blue Trading Systems

Facebook: Blue Trading Systems